During April and early May, Newton-Evans Research is conducting studies on the American wind power market. Of specific interest is the wind turbine controls segment of the fast-growing renewables business.

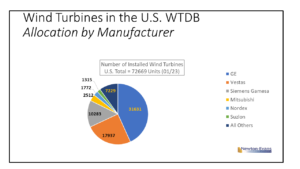

We are researching the types and brands of control devices and control systems that are in use among the more than 72,000 wind turbines installed in the United States as of January 2023.¹

Importantly, most controls within the wind turbine itself are provided by the OEM – the wind turbine manufacturer. In the U.S., that likely means one of six manufacturers that account for 90% of all utility-scale wind turbine installations as of January 2023. Three of the six (GE, Vestas, Siemens Gamesa) accounted for a whopping 82% of wind turbine installations. Three others (Mitsubishi, Nordex and Suzlon) account for nearly 6,000 operational wind turbines operating throughout the country. In addition to the major OEMs, there are more than 10 other manufacturers having at least 50 or more operational U.S. wind turbine installations. See Figure 1. (Click on the figure to expand the view).

When it comes to wind turbine controls, multi-site wind farm operators and owners have more say in determining control devices and control systems selections as needed, especially for controls that reside external to the wind turbine. Larger wind farms configured with wind turbines from multiple manufacturers also tend to have more interest in procuring PLCs, SCADA systems and plant-wide and multi-plant control and monitoring systems. Wind farm operators and owners also tend to make more of the turbine control selections when it comes to retrofitting wind turbines.

There are more than a dozen wind controls specialist firms actively marketing and installing pitch and yaw controls, and/or condition monitoring systems in the United States. Many wind turbine control specialists active in the U.S. are headquartered in European countries having extensive wind power installations and decades of wind power experience, led by firms based in Denmark, with others in Spain, Germany, Austria and Italy. Some companies provide their own fine-tuned PLCs and wind-specific SCADA systems (you can read our 2021 article on renewables SCADA here): https://www.newton-evans.com/scada-systems-for-the-renewables-energy-industry-and-adms-for-utilities/.

We are still seeking a few additional participants to two short surveys. One survey is geared to wind farm operators/owners, and can be answered by experienced wind turbine technicians. The second survey addresses the OEM and wind turbine controls supplier community. If you qualify to participate, please contact Chuck Newton (cnewton@newton-evans.com) and a link to the appropriate survey will be forwarded.

Note: 1. Wind turbine installation data is provided by the U.S. Geological Service: https://eerscmap.usgs.gov/uswtdb/

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies