2015 was another busy year for Newton-Evans Research. Some of the studies conducted this past year covered new research topics. While our work was focused on client-commissioned studies, we obtained many insights from operational and engineering perspectives that will assist our research programs in 2016 as we once again conduct our flagship multiclient studies of protection and control, substation modernization, and operational control systems with utilities around the world. For over 30 years Newton-Evans has observed and reported on the fundamental shifts in operational systems and electric power infrastructure technology developments and usage patterns. In 2016, there will be additional changes in usage patterns, plans and outlooks among operational end engineering officials to note, both in North America and internationally.

T&D Equipment Testing Topics

During 2015, three of our study programs were commissioned by major electrical equipment test laboratories. By year-end we were had gained a good understanding of the role and importance to the electrical power industry concerning the use of lab and field testing of electrical equipment used in transmission and distribution networks. The need for equipment testing cuts across voltage ranges (low, medium and high voltage products) and across the types of infrastructure equipment categories (switchgear, transformers, breakers, cable, etc). While advanced equipment testing services are offered commercially by a few firms, some testing is also performed within the manufacturing community itself as well as at utilities and universities specializing in power engineering studies.

We interviewed officials from commercial lab services, equipment and cable manufacturers, utilities and engineering firms and OT consultants. We learned that while there are a relatively few major lab facilities that can conduct High Power testing, there are many labs that can conduct high voltage tests, including a few dozen non-commercial sources such as utility and university labs. High Power equipment testing (for low, medium and high voltage equipment) is a critical process undertaken by manufacturers prior to commercial product launch into the marketplace. Interestingly, in the U.S. market most such testing is driven by the need or desire to be in compliance with standards developed by IEEE, ANSI and/or NEMA.

In addition to two commercial labs providing High Power test facilities (KEMA PowerTest – a unit of DNV GL, and Powertech – a BC Hydro subsidiary), there are a handful of manufacturers that operate High Power test labs for their own business units. Some of the manufacturer-owned labs provide overflow testing services to other manufacturers. Among the T&D equipment manufacturers operating High Power test facilities, Eaton Corporation operates three such labs, while Schneider Electric, Allen-Bradley, Littelfuse, Mersen and S&C each operate one High Power laboratory in the U.S.

The third major commercial equipment test lab in North America (after DNV KEMA and Powertech) is the Toronto-based company KINECTRICS – a leader in short-circuit testing of T&D equipment and in the provision of HV and MV cable field testing services.

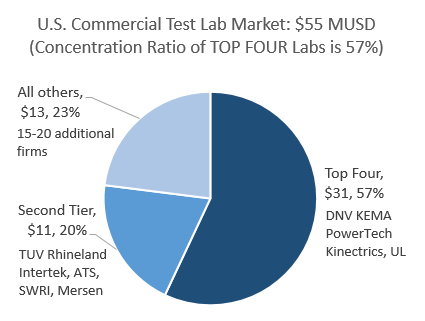

All in all, commercial testing labs for T&D equipment, together with the revenues obtained by other equipment testing labs making facilities available to T&D equipment manufacturers represent about a $55 Million market in North America. In addition to the three major labs already mentioned above, other more generalist electrical test labs like UL, and several European-headquartered labs are also important providers of some types of equipment testing. Some of these multinational test labs provide services to multiple other industries, and such firms include Intertek, TUV Rhineland, SGS and MET Labs.

When the lab testing services provided by utility-operated labs, university operated labs and manufacturer-operated labs are combined with commercial test lab revenues, the total expenditures spent on lab testing of transmission and distribution equipment amounts to more than $400 million per year in North America.

While hundreds of electric utilities continue to operate smaller test labs (typically to test meters and relays and perhaps smaller DA devices) fewer major utilities continue to operate high voltage labs and some perform a range of tests similar to those typically provided on a larger scale by the commercial test labs.

Electrical engineering schools offering advanced power engineering courses are another source of significant lab testing of electric infrastructure equipment. Some of the major electrical equipment manufacturers are key partners of, and/or donors to university labs, typically at universities located nearby the equipment production locations.

Substation Re-Design Using 3D Technology

In 2013 Newton-Evans completed a study of “greenfields” substation design efforts that incorporated 3D design software. This past autumn, we looked into the use of 3D techniques for use in modernizing existing “brownfields” substations. Significant interest was expressed by the participating utilities. In fact, the importance of upgrading many of the nation’s more than 60,000 utility-operated transmission and distribution substations is a high priority for scores of utilities.

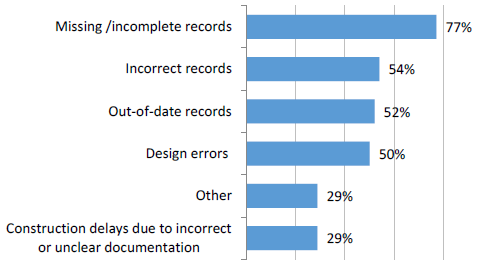

One of the major hurdles that utilities reported this year in two somewhat related studies is the accuracy and validity of historical record-keeping for substation work over the years. Missing and incomplete date records continue to pose significant challenges for substation planners.

Challenges to Brownfield Substation Projects as Indicated by Electric Utilities

While the data recording issue may be significant in itself, the growing reliance on third parties and contractors for substation re-work poses another difficulty. Physical design and electrical schematics design together comprise about one half of all design time requirements. Visual inspection remains vital in validation of legacy design data accuracy with “as-built” projects.

There are some noticeable differences in observations between North American and International respondents affecting communications rework and protocol usage as American utilities continue to use DNP 3 – with many upgrading from serial to LAN editions – while their international counterparts tend to move more rapidly to IEC 61850 and related IEC substation protocols. North American utilities are lagging somewhat in adoption of 3D design tools, as international respondents reported more automated design processes in use than did their North American counterparts.

One of the key findings in this commissioned study is that a significant percentage of the utilities that participated in the study do plan to include some elements of 3D design methods during the coming year as part of their substation modernization efforts.

Single Phase Reclosers – Ever More Useful as Growth of the Installed Base Continues

Some key findings from this first quarter 2015 North American utility study suggest the following: Canadian and U.S. electric utilities predominantly use fuse protection on single phase taps rather than use a single phase recloser. While the bulk of survey respondents indicated a greater installed base of oil insulated single phase reclosers, on an average annual basis some major utilities indicated they purchase many more solid dielectric reclosers than oil insulated. In addition, nearly one-half of the respondents said that over 70% of future recloser purchases will be for new units and not for replacements. This finding means the market is actually growing for placement and siting of additional (net new installations) thousands of units of MV single phase reclosers in North America.

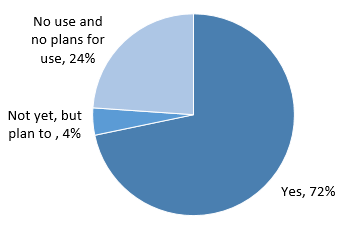

Nearly three-quarters of the respondents indicated current use of 1-phase reclosers and another four percent plan to use single phase reclosers. All 13 cooperative officials cited some use of single phase reclosers at their utilities.

Electric Power Utility Usage of Single Phase Reclosers

The vast majority of the reclosers purchased by the responding utilities over the next three years will be installed on feeder mains compared to 1-phase laterals on both the 15kV and 26kV systems. No utility indicated they had any plans to use single phase reclosers of 38kV laterals.

Most utilities indicated the majority of their 15kV laterals are protected, but are protected by and large, via the use of fuses. Few 1-phase laterals are protected by reclosers and even fewer by electronic sectionalizers.

When asked “What criteria does the utility use in selecting a recloser installation instead of fuse protection or electronic sectionalizers?” utility officials offered a wide range of replies including: the number of customers (amount of load) down line of device location; length of the overhead line; high tree growth areas, frequency of circuit operations and customer complaints.

Additional utility participant comments on recloser usage patterns included these insights:

- Reclosers are used for all first fuse points for the main line on a circuit. Additional reclosers may be installed when the need exists for a SCADA controllable device at a midpoint or an open point.

- Number of customers/amount of load on lateral, coordination with upstream protective device. For 3 phase main, moving towards every 500 customers for 3mva of load.

- We use a soft evaluation combining the number of customers along with exposure. Very rarely, due to high fault currents close to a station, we will be forced to use a fuse instead of a recloser.

- Typically it is coordination issues. But can be driven by outages and the desire to isolate heavily treed areas. It also may be customer driven. We have stopped using sectionalizers (1 or 3 phase) unless it is a last resort. We are typically not purchasing 1-phase reclosers unless it is for a special purpose. We typically buy devices that can trip single or three phase (via settings).

- We do not deploy any sectionalizers due to our short lines. Fuse vs. reclosers depends on many variables such as length of line, upstream loads/subdivisions, and downstream loads/subdivisions. Cost benefits (e.g. expensive reclosers for low number of customers.

- Amount of overhead vs. underground and condition and width of Right of Way).

- An algorithm that takes into account customers served, energy served, line exposure (length). Of course fault interrupting capability is important in some cases.

- Amount of nuisance tripping. Long drive times for troublemen to re-fuse.

- We have been using tree and branch related outages on overhead as an indicator. If we have several outage records and the feeder has not been performing well from an outage perspective, we will choose reclosers in an attempt to reduce outages.

Role of Operational Technology Consulting Firms

There are a large number of consulting services providers to Operations and Engineering staffs in the electric power industry. In North America, Tier One providers include the STRUCTURE business unit within Accenture, KEMA DNV GL, QUANTA-Technology, PE (Power Engineers), PSC, SISCO, UISOL and others. Several of these firms have their origins as T&D engineering consultants, somewhat akin to the expertise found at the very large firms such as Black & Veatch, Burns & McDonnell, Bechtel and others.

Since the turn of the century and the development of grid modernization studies extending to OT/IT integration, and to enterprise-wide consulting services, a number of additional consulting specialists such as Enernex, Nexant, Bridge Energy, Navigant are highly visible and competing with the more “traditional” OT consulting community.

Additional firms are also active in related segments of grid modernization activities including telecommunications specialist firms (UTCG, PWI, Boreas, Telcordia, PSI, and carriers); Cyber consulting specialists (Tripwire, Industrial Defender, Waterfall, IPKeys, NetSecTech, N-Dimension and Securicon) and market management specialists (OATI, PA, Scott-Madden).

The survey conducted during the fourth quarter of 2015 was concerned in part with the perceived changes taking place among the consulting community that serves operational technology needs of electric utilities.

Some of the summary highlights of one study include these observations:

Three of five key integrators of control systems look upon OT specialist consultants as “fair and impartial” while two suggested that consultants do have their “favorites” among the systems provider community.

Integrator officials also provided their thoughts on the future role for OT consultants as follows:

- “Niche players will increase due to that the DER penetration will drive new regulation and requirement for ADMS (distribution)”

- “Difficult to say with certainty, but I don’t think the consultant roles will change much.”

- “I believe consultants will be supporting more and more project implementation for the end customer as the key internal knowledgeable resources are become less available.”

- “To be a trusted partner to a utility to help guide them, but not make decisions on their behalf or to further benefit from those decisions. The role of being part of a procurement (RFP/RFI) process and then to provide system integration services for the selected bidder is raising major ethics concerns. “

- “I don’t think much will change over the next 4 years.”

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies