Findings from the Newton-Evans Research Company study completed in February 2015 indicate that a substantial number of electric utilities are using distribution automation technologies such as FDIR/FLISR and VVC/VVO/CVR, but the number of operating feeders currently configured with these features is still relatively low. These observations are based on a survey of 75 electric T&D utilities in the U.S. and Canada providing electric power service to 32 million customers (approximately 20% of North America’s electricity end users, according to Newton-Evans estimates.)

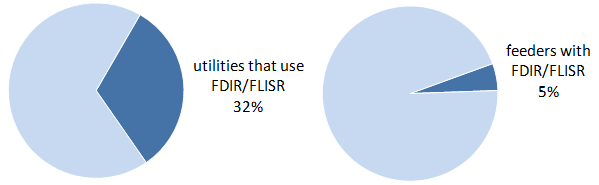

Percentage of all feeders that have Fault Detection Isolation Restoration (FDIR) or Fault Location Isolation Service Restoration (FLISR) Capabilities

On a summary basis, nearly one-third of the responding utilities (32%) cited their operation of one or more primary distribution feeders configured with FDIR/FLISR capabilities. However, the overall installed base of feeders with FDIR/FLISR capabilities was quite small, standing at about five percent of the total number of feeders operated by these utilities. According to the survey sample, six percent of 13-15kV feeders and seven percent of 22-26kV feeders are configured to provide FDIR/FLISR functionality.

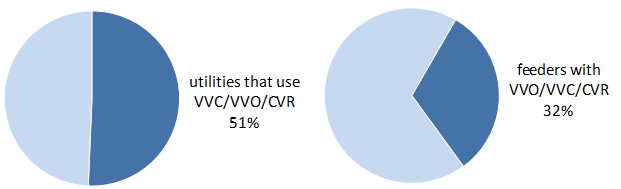

Percentage of feeders that support integrated Volt/VAR control (VVC), Volt Var Optimization (VVO), or Conservation Voltage Reduction (CVR)

Just over half of all respondents reported having at least some feeders supporting Integrated Volt/Var Control, Volt/Var Optimization (VVC/VVO) or Conservation Voltage Reduction (CVR). The 75 respondents indicated an installed base of 34,122 feeders across 4 voltage levels: 4kV (5,094 feeders), 13kV/15kV (22,831 feeders), 22kV/26kV (4,214 feeders), and 33kV/38kV (1,983 feeders). Overall, respondents indicated that 32% of all feeders currently support VVC, VVO or CVR, but out of 4,214 feeders at the 22/24kV level about 59% support these capabilities.

Percentage of utilities integrating VVC, VVO or CVR by year end 2017

Overall, 68% of the utilities replying to this question indicated that at least some feeders will support integrated IVV control/VVO and/or CVR by year-end 2017.

Decision factors for implementing VVC/VVO

Respondents indicated that “cost savings effected by reducing the need for infrastructure enhancements” was the single most-cited driver for volt-Var optimization (VVO) implementation, as reported by 38% of respondents. Additional cost savings brought about by “reducing the need for additional generation” was second in importance, at 33%. About 1 in 5 respondents also cited “regulatory compliance” as a significant driver for implementing VVO.

Other reasons mentioned for implementing include peak shaving to reduce demand costs, reducing losses, and maintaining power factor. A few utilities mentioned that VVO is either not a requirement for them or that they do not want to implement additional technology simply to raise revenue.

To see a table of contents and pricing information for the “North American Distribution Automation Market Assessment and Outlook: 2015-2017” visit our reports page

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies