7 November, 2019. Ellicott City, Maryland. Based on the findings obtained in a recently completed study of the distribution transformer market in the United States, Newton-Evans provides the following information summary.

Distribution Transformer Market Size Estimates

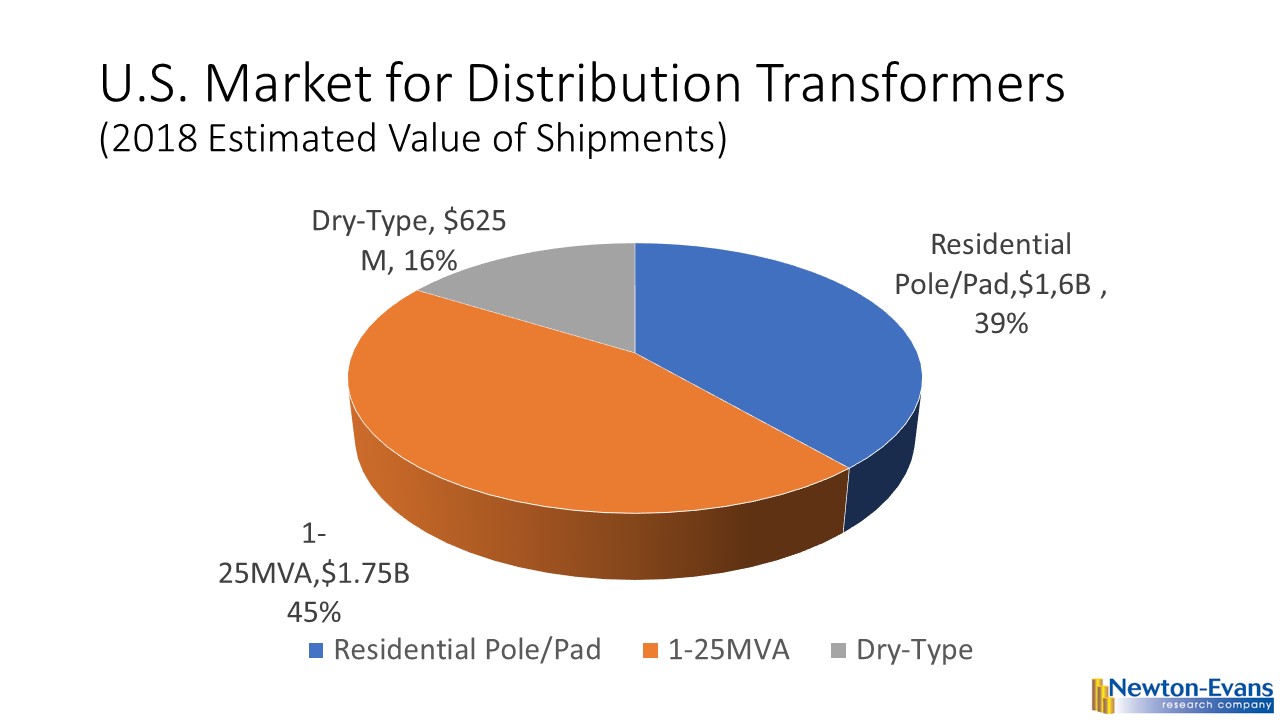

The aggregated U.S. market for three groupings of distribution transformers stood at about $3 Billion in 2018 as seen in the above chart. The market was segmented by Newton-Evans as shown here to include residential pole and pad mount units; dry type transformers, and small power/large distribution transformers ranging from 1-25 MVAs.

Institutional Barriers to U.S. Market Entry for Distribution Transformers

The third quarter 2019 Newton-Evans study included survey questions for both end-users and suppliers about any institutional barriers they see to potential market entry by non-North American manufacturers.

Among utility respondents, nearly one-half indicated compliance with recently enacted DOE regulations and recommendations for energy efficient distribution transformers as being a key barrier to market entry by foreign-based suppliers (outside of the NAFTA region). One quarter indicated “buy American” programs at their utility was also a deterrent. About 1 in 5 respondents indicated that Underwriters Lab certification was also important, and several respondents had other supporting comments to offer.

Suppliers commented that the enactment of tariffs also served as a deterrent to foreign manufacturers, while one of the largest domestic suppliers of overhead distribution transformers cited the importance of rapid post-storm response times as being a key factor in re-supplying utilities quickly. Another major U.S. transformer manufacturer cited three factors: UL Certificate requirement, DOE Efficiency requirements and “Buy American” initiatives.

Special Technical Requirements for Distribution Transformers Used with Renewables Sites

Additional transformer product requirements included “… higher current bushings and k factor insulation” while a second respondent indicated the importance of using a “loss formula” to calculate sizing requirements at renewables site installations.

Among manufacturer respondents, one reply included the following with regard to special requirements for transformers at renewables sites: “Yes, specific load profile, internal harmonic withstand, overloadability, and overall quality and unit lifetime.”

Another indicated: “yes – wind requires onerous qualification for the dry type transformer used in the nacelle.” A major transformer services firm participant reported: “The unit must be designed to withstand harmonics generated by Wind Turbines and Solar farms. Inverters are used to convert DC to AC, and the ‘normal’ distribution transformer is expecting a clean 60 HZ sine wave. This is not the case with outputs from inverters. See IEC 60076-16 NEW loading guide for standards to be met for these applications.”

Market Trends for Residential Pole-Tops and Pad-Mounts: Prices for 1-phase overhead units range from about $700 – $3,500 dependent upon kVa ratings. With the market currently standing at about 650,000-750,000 units per year, the median price is about $1,600-$2,500 (selected bid sheet tallies from 2015-2018) Typical life span for 1-phase pole-top units is 32 years, with variances by geography and specific siting situations. For padmount and three-phase units, bid price ranges as found by Newton-Evans have ranged from $3,500-$12,000 depending on order quantity and kVA ratings. The majority (70-80%) of distribution transformers are being sold directly from manufacturers to larger utilities/end-users (IOUs and large industrials) while smaller munis, co-ops and industrial/commercial sites tend to purchase via reps and distributors.

1-25 MVA Transformers: Much of the cost of these larger transformer units depends on manufacturing material costs (especially copper and steel) which accounts for a wide variance over relatively short time frames in bids from utilities and industrial users of small power transformers. With other variables such as primary and secondary voltage ranges, number of taps, size and weight of the unit, temperature rating and the like taken into consideration, it appears to Newton-Evans that mid-2019 prices for the 10-100 MVA units range from $30,000 to $40,000 per MVA.

Dry-type distribution transformers: Newton-Evans’ Chuck Newton stated “Price variations are significant for dry-type units, dependent upon the following dry-type transformer factors: kVA rating, 1p or 3p unit construction; primary and secondary voltage level; number of taps, temperature variance; frequency, type of windings, type (ventilated or encapsulated), sound levels, electrostatic shield requirement and K-factor. Our study found several suppliers in this segment, led by HPS, with at least four other companies sharing a double-digit share of this half billion-dollar market.”

Priorities for Distribution Transformer Equipment Selection Factors

About 75% of utility participants ranked price as the most important factor, when all technical compliance requirements have been met. A handful of others ranked it second or even third in importance. For lower valued equipment bought in quantity, the key reasons for supplier selection included price and delivery.

For larger, more expensive 1-25 MVA transformers, key reasons for using current suppliers expanded to include tech support, supplier reputation and delivery lead times.

For dry-type transformers used primarily by industrial and commercial end-users, key factors paralleled those reported for pole-top and residential pad mount units (price and delivery times). An additional manufacturer respondent also noted the value of “establishing personal relationships developed over time either by us or by our channel partners.”

The Newton-Evans’ study of distribution transformer market trends, completed in September, 2019, included interviews and surveys with more than 60 distribution transformer officials from manufacturers, channel intermediaries and electric utilities. Several earlier Newton-Evans studies were also reviewed and excerpts from those studies were included in the new study.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies