With the early October 2021 completion of the GE-PROLEC acquisition of SPX Transformer Solutions, the transformer manufacturing industry is again itself transformed a bit. With this acquisition the combined GE-PROLEC venture now takes on a co-leadership position in the “low power, middle range and higher range segments” of the U.S. power transformer market.

SPX Transformer Solutions has been the U.S. market segment leader in the manufacture and sales of small power, medium power and large power transformers. GE-PROLEC was already a third-place contender in the U.S. market for medium power transformers, shunt reactors and phase shifting transformers. Historically, GE has been a dominant supplier of network transformers as well, and remains a segment co-leader. Neither GE-PROLEC nor SPX Transformer Solutions has been a market leader in the provision of mobile transformers/substations, but other than that particular segment, the combined unit shipments and dollar values likely provides GE-PROLEC a market leading share of at least five segments of the power transformer business. While GE-PROLEC is a “top five” participant in each of the three major categories of distribution transformers (overhead liquid units, dry transformers and pad mount units), the acquisition of SPX Transformer Solutions has no effect on their standing for distribution transformers.

Transformer Monitoring and Diagnostics:

GE historically has offered a wide range of solutions to monitor and manage critical assets on the electrical grid, detect and diagnose issues and provide expert information and services to customers. GE’s asset monitoring and diagnostics portfolio includes solutions for single- and multi-gas transformer DGA, enhanced transformer solutions and switchgear monitoring, as well as software and services. GE was early into the transformer DGA monitoring business with its 1999 acquisition of the Montreal-based Syprotec organization. The company’s efforts in transformer monitoring developments since then have made it a global leader in transformer health monitoring and diagnostics.

Waukesha’s transformer service business has been a mainstay for SPX in years during which equipment sales were flat or down, with the company’s service capabilities and offerings extended to provide service for non-Waukesha power transformers.

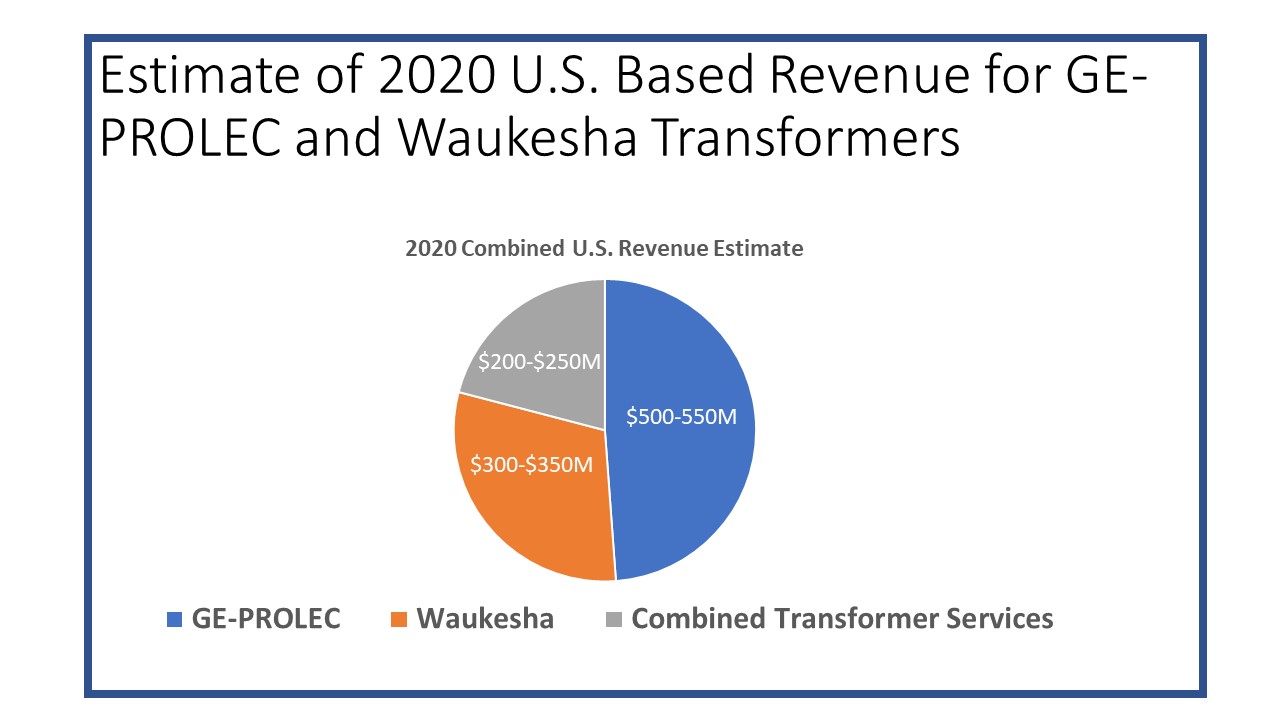

Revenue Estimates:

Newton-Evans estimates global revenues for the combined transformer equipment and services operations of the GE-PROLEC plus Waukesha (SPX Transformer Solutions) will exceed $1.5 Billion in 2021. In the U.S. market, our 2020 estimate for GE transformer equipment sales in the U.S. market stands at $500-$550 million, and for Waukesha transformers our 2020 estimate of U.S. shipments is $300-$350 million out of a reported total of $427 Million in power transformer sales.

Combined GE-PROLEC and Waukesha transformer-related services and M&D device sales revenues in the U.S. are likely to reach $200 Million or more, with multiple regional service facilities operated by the combined business units.

Some History on GE’s Rise in the Power Transformer World Market

Back in 2014, during the time of GE’s acquisition of Alstom Grid, the latter firm was number three in the world in terms of large power transformer market share and assets, operating 13 plants with an annual production capacity of more than 130 MVA. GE Prolec was already a major North American market force with about a 14% share of the U.S. market.

At that same time in 2014, I had written the following: “Together, this alliance may become number three in the global market for large power transformers behind ABB and Siemens. To do so, the GE-Alstom combine will have to fend off HICO, Hyundai, Toshiba and MEPPI as well as three up-and-coming Chinese manufacturers.” With additional non-organic revenue additions of nearly $500 Million achievable this year with combined reporting from Waukesha, GE-Prolec will indeed firm up its position as the third leading supplier of power transformers – no longer far behind Siemens Energy and Hitachi-ABB Power Grids.

Sources:

(1) Newton-Evans Research Company’s 2021-2023 edition of Market Overview Reports: Transformer Series-Complete Set

(2) 2020 Annual Report for SPX Corporation.

(3) 2020 Annual Report for General Electric Corporation.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies