The Newton-Evans Research Company continues to assess its findings from the firm’s comprehensive 2017 study of EMS, SCADA, DMS and OMS usage patterns among utilities from more than 30 countries.

Current status of Advanced DMS (ADMS)

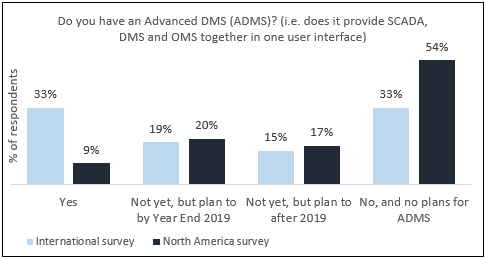

The Newton-Evans’ survey asked respondents to indicate whether their DMS installation provided SCADA, DMS and OMS functionality together in one user interface and this served as our definition of ADMS for this study.

Overall, 69% of international electric utilities who responded to the survey either currently have or plan to have an Advanced DMS that provides SCADA, DMS and OMS together in one user interface. Thirty-five percent currently have ADMS, and 34% plan to implement ADMS in the near future.

This contrasts with only 9% of North American survey respondents who reported having an ADMS as of the first quarter of 2017. Twenty percent of North American respondents indicated they will have an ADMS by the end of 2019, and another 17% indicated plans for implementing an ADMS sometime after 2019. Overall, 46% of the North American sample either currently has or plans to have an ADMS. Some of the North American sample included “transmission-only” utilities/ISOs.

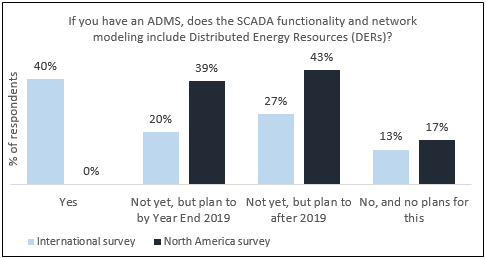

SCADA functionality and network modeling to include Distributed Energy Resources (DERs)

Of the international respondents who said they either currently have or plan to have an Advanced DMS, 40% indicated that the SCADA functionality and network modeling includes DERs. Almost half of this sub-sample said they are planning to include DERs in their ADMS functionality in the future, while only 13% of the sub-sample have no plans to do this.

Of the 30 North American respondents who said they either have or will have an Advanced DMS (or ADMS), none indicated that the SCADA functionality and network modeling currently includes DERs. However, most of this sub-sample (82%) said they are planning to include DERs in their ADMS’s functionality in the future, while only 17% of the sub-sample have no plans to do this.

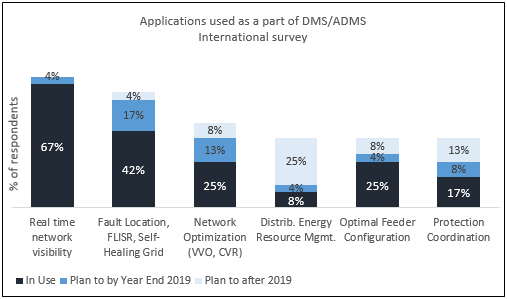

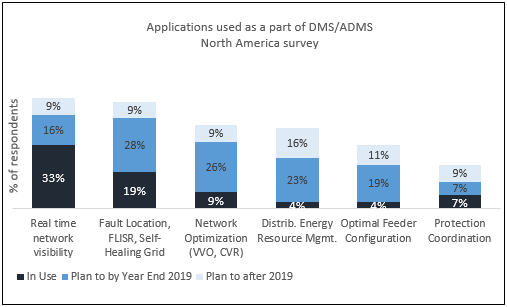

Applications Included as part of today’s DMS and ADMS installations

According to the survey results, there appears to be a more aggressive adoption of applications for DMS/DMS among international utilities when compared with the slower pace of adoption being undertaken and planned by North American utilities.

Sixty-seven percent of international respondents currently use real-time network visibility, followed by 42% who currently use FLISR. One-fourth currently use either network optimization or optimal feeder configuration. Survey findings indicate the most growth will be for distributed energy resource management systems or DERMS; almost thirty percent indicated that they plan on integrating this into DMS/ADMS by year end 2019 or later.

Real-time Network Visibility is the DMS application most used by the North American survey sample. Thirty-three percent of responding utilities currently use this application, while 25% plan to have it later on. Nineteen percent said their company currently use FLISR, and thirty-seven percent said they plan on having FLISR as part of their DMS or ADMS.

Further information on the just-released 2017 four-volume series, The World Market Study of SCADA, Energy Management Systems, Distribution Management Systems and Outage Management Systems in Electric Utilities: 2017-2019 is available from Newton-Evans Research Company, 10176 Baltimore National Pike, Suite 204, Ellicott City, Maryland 21042. Phone: +1 410-465-7316 or visit our reports page or to order any of more than 100 related electric power industry reports. For readers interested in purchasing this new series please call or email the company for special introductory pricing: info@newton-evans.com

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies