The total MV services market is very large – possibly in excess of $15 billion. This larger view of the MV services market encompasses multiple segments such as field and in-plant equipment maintenance and refurbishment; construction-related services for distribution substations and MV under-grounding activities; training classes for utility/C&I engineering and operations staffs; site analysis and permitting for distribution utilities and renewables projects; and MV equipment testing services, including commercial test labs and field service diagnostics and testing firms. In addition, vegetation management and telecommunications services are both very large power utility-related businesses in their own right, with significant portions of segment revenue obtained from medium-voltage projects, and these topics will be covered in articles later in 2024.

U.S. Medium Voltage Equipment Services

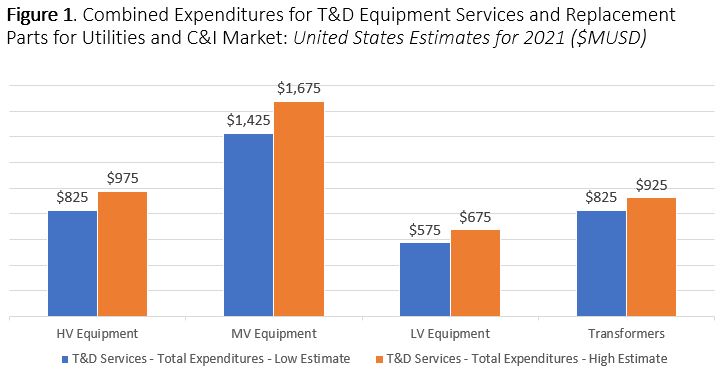

The U.S. MV equipment services market itself is very large (>$4 billion is our estimated minimum market size) in total, comprised of at least three major sub-segments and is served by hundreds of national, regional and local-area electrical equipment service providers.

While much of MV equipment services growth for third party firms seems likely to be in the 3-5% range, there are a few areas that may see larger increases in revenues, including the upper MV ranges of switchgear, along with gas-insulated units and underground equipment. As well, transformer maintenance, repairs and retrofits are commanding more attention and relying on third party services as new transformer prices, product availability and long lead times affect grid reliability.

Numerous MV Maintenance Market Participants

In multiple research studies conducted over several decades, Newton-Evans Research has found more than 275 U.S.-based companies and organizations provide one or more types of MV equipment-related services to electric utilities and to C&I customers. Each of these was earning related revenues of at least $10 million in annual revenue, with about 45-50 firms in the group earning in excess of $20 million annually from the provision of MV-related services. There is a growing group of domestic firms earning in excess of $250 million in MV services revenue. Another large segment of commercial providers offers services in addition to equipment maintenance, repair and refurbishment. These include utility staff training services, equipment testing services and some portion of construction related (design/build) services.

When it comes to MV equipment services, two product categories account for the lion’s share of segment revenue. These are switchgear/circuit breaker and distribution transformer equipment services. Let’s take a closer look at these.

MV Switchgear Services Revenue Assumptions based on Third Party Service Firm Website Information

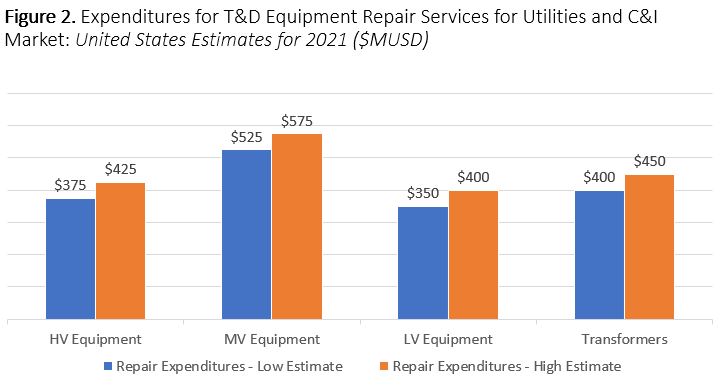

Switchgear services (maintenance, repair, refurbishment and re-manufacturing) are often grouped with similar Circuit Breaker services and together account for several hundred million dollars of utility and C&I expenditures. There are national, regional and local area third-party T&D services firms that provide various levels of equipment services for utilities and the C&I communities. Some of the national names prominent in the switchgear services, maintenance and repair/refurbishment market include Shermco, CBS Services and Saber Power Services.

While many services firms are in the “small business” category and earn less than $10 million annually, there are several others that earn in excess of $100 Million from a variety of T&D equipment service offerings.

Distribution and Power Transformers

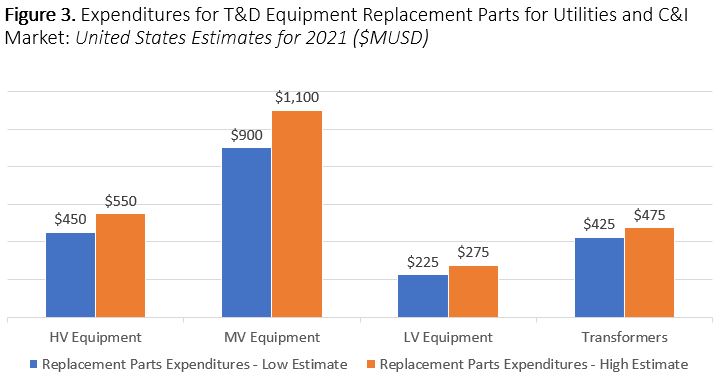

While Newton-Evans estimates as much as $900 million is spent annually on electric power transformer services and replacement parts, the majority of this amount goes for power transformers. Nonetheless, there are several firms that specialize in service and repairs for pole-top and pad-mount distribution transformers. Among the large firms that service, repair and refurbish transformers of all sizes and offer nationwide services, include companies such as IPS, Sunbelt Solomon, RESA and others. A number of smaller firms specialize in maintenance, repairs for distribution transformers at a regional level, including Northeast Power, UTB Transformers and Valley Transformers, Inc.

Twenty years ago, a Newton-Evans survey found that many utilities did not bother with repairs to, nor did they consider third party maintenance, of pole-mount distribution transformers. Unit replacement was easier and faster than was rework and repair. At that time, manufacturing capacity for pole-mount units was sufficient to meet domestic U.S. demand, and lead-times were quite short, compared with today’s market. Most electric power utilities had been able to procure and store scores or hundreds of spare pole-top units for emergencies or time-based replacement up until the COVID years.

All Other MV Equipment Services: The third arm of MV equipment services we consider to be comprised of “all other” equipment of significant cost – that is, costing multiple thousands of dollars. Based on a small sample utility survey conducted during late 2023, it appears that relatively low-cost equipment including reclosers, sectionalizers, fuse links, distribution line monitors, fault current limiters, surge arresters and MV capacitors were very likely to be replaced rather than repaired.

Our next article on MV Services will focus on construction-related services for distribution substations and MV undergrounding activities; training classes for utility/C&I engineering and operations staffs; site analysis and permitting for distribution utilities and renewables projects; and MV equipment testing services, including commercial test labs and field service diagnostics and testing firms.

Keep in mind if you need to have an understanding of the U.S. medium voltage equipment market, our report series of two to four page U.S. market overviews, covering 17 MV equipment types, may be helpful to you. The link for for further information and to place an online order is here:

https://www.newton-evans.com/product/overview-of-the-2024-2026-u-s-transmission-and-distribution-equipment-market-medium-voltage-series/

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies