Findings Corroborate Earlier Newton-Evans Studies Regarding “Mixed” Placement of Controls of Field Devices

The Newton-Evans Research Company today released key findings from its newly published study of electric utility plans for distribution automation. Entitled “North American Distribution Automation Market Assessment and Outlook: 2018-2020” the 74-page report includes coverage of more than 30 DA-related issues.

Progress Being Made with Distribution Automation Programs

North American utilities are making progress, by and large, in developing and implementing new DA applications and installing telecommunications network upgrades to accommodate DA device transmissions. The overall DA market among North American utilities is approaching $1.5 billion and is expected to continue to grow in the near-term and mid-term.

DA Controls Placement

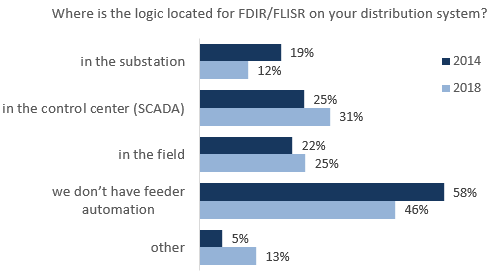

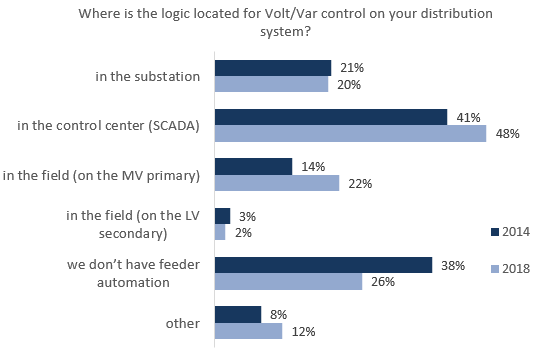

The placement of DA controls for field devices remains mixed. That is, while some see controls being distributed to field locations, others are placing controls on substation automation platforms, while an even larger group is using control center systems-based approaches (with DA applications co-resident on SCADA-DMS and ADMS platforms).

The outlook for controls placement in the future is to bring more of such controls for fault detection, isolation and service restoration (FDIR/FLISR) and for volt/Var control and optimization (VVC/O) into the control center as shown in the following charts.

Consideration of Trial Deployments to Manage Distributed Energy Resources (Inverters, Energy Storage, EV Chargers, Etc.) Within The DA System

Twenty-five percent of this year’s respondents indicated that they are considering a trial deployment of DER management within the scope of their utility’s DA activities and plans. This is slightly higher than what was observed in the 2014 survey (15%). About one quarter of responding utilities this year indicated they plan to do undertake trial deployments of DER in conjunction with their DA program in the future.

Integration of Communications and Controls for Distributed Generation into DA System Architecture

Twenty-three percent of respondents reported that they have integrated some communication links or controls for DG into their DA system architecture. This is slightly higher than what was observed in the 2014 survey, which had found that 16% of the utilities surveyed were doing so.

More than 30 additional topics are covered in the 2018-2020 Newton-Evans DA report. Fifty-three major and mid-size utilities were surveyed and interviewed to gather the information for the new report. This group provides a sample accounting for 10% of served North American electricity customers while operating more than 50,000 primary MV distribution feeders across North America.

A supplemental nine-page North American DA market outlook synopsis for the years 2018 through 2024 is included in this report. The supplement provides DA market outlook information and rationale for each of five DA components including field equipment, substation resident software, control systems-resident software, telecommunications services and automation device controllers.

This 2018 DA Market Study is sold individually and also as part of a report bundle on DA that includes: 1) the “Overview of the 2017-2020 U.S. Transmission and Distribution Equipment Market: Distribution Automation Series (Complete Set of 9 top-line reports)” and 2) a Power Point slide deck developed by Chuck Newton titled, “The Role of Advanced DMS/SCADA Software and Systems in Building a Resilient and Reliable Power Distribution Grid.”

Contact us for more information, report samples and pricing information:

info@newton-evans.com

410-465-7316

https://www.newton-evans.com/our-reports/

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies