March 22, 2021. Ellicott City, Maryland. The Newton-Evans Research Company has announced publication of a set of 15 U.S. high voltage equipment and substation market two-to-four-page summaries. The new series of market overview reports (executive market summaries) includes supplier listings, representative products, and estimated market size for each topic, including vendor market share estimates and market outlook through 2023. Electric utilities accounted for about 86% of HV-related equipment and transmission substation spending overall.

- Commercial and industrial end-users accounted for more than $300 Million on substation construction projects in 2020, according to Newton-Evans’ estimates. Much of this amount was for construction of renewable energy gathering substations.

- Substation construction represents the largest single investment area among all bulk power system components.

- HV gas-insulated substations and gas-insulated switchgear represent a growing segment of bulk power-related investments. Growth is likely to accelerate once non-SF6 gas alternatives are more widely available for higher voltage equipment.

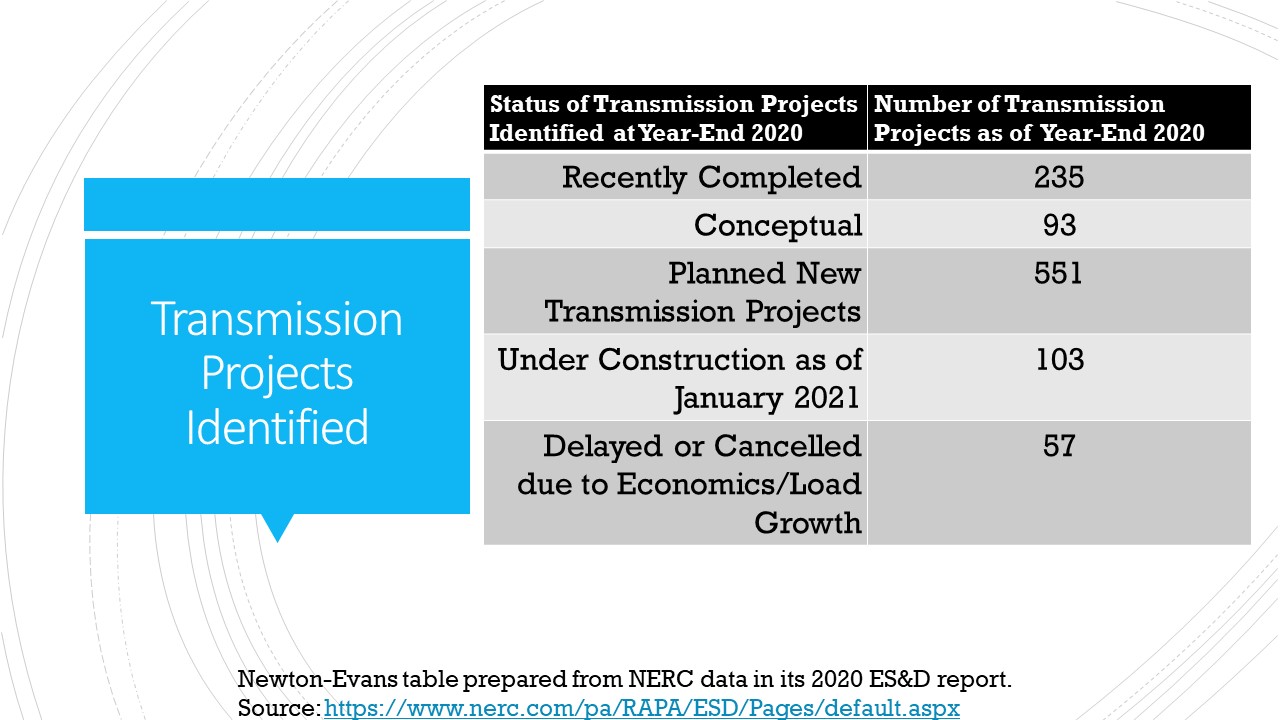

- NERC projections suggest that as many as 14,000 HV line miles will be constructed over the 2021-2030 period. Importantly, more than one half of the expected expansion will be at 200kV or higher. This will mean a need for about 250-300 new/up-rated transmission substations.

- IOUs, G&Ts and federal agencies were most closely identified as having HV substation construction plans. Distribution cooperatives, municipal operations and industrial sites were more likely to plan MV substation construction projects. Following is a look at identified transmission projects.

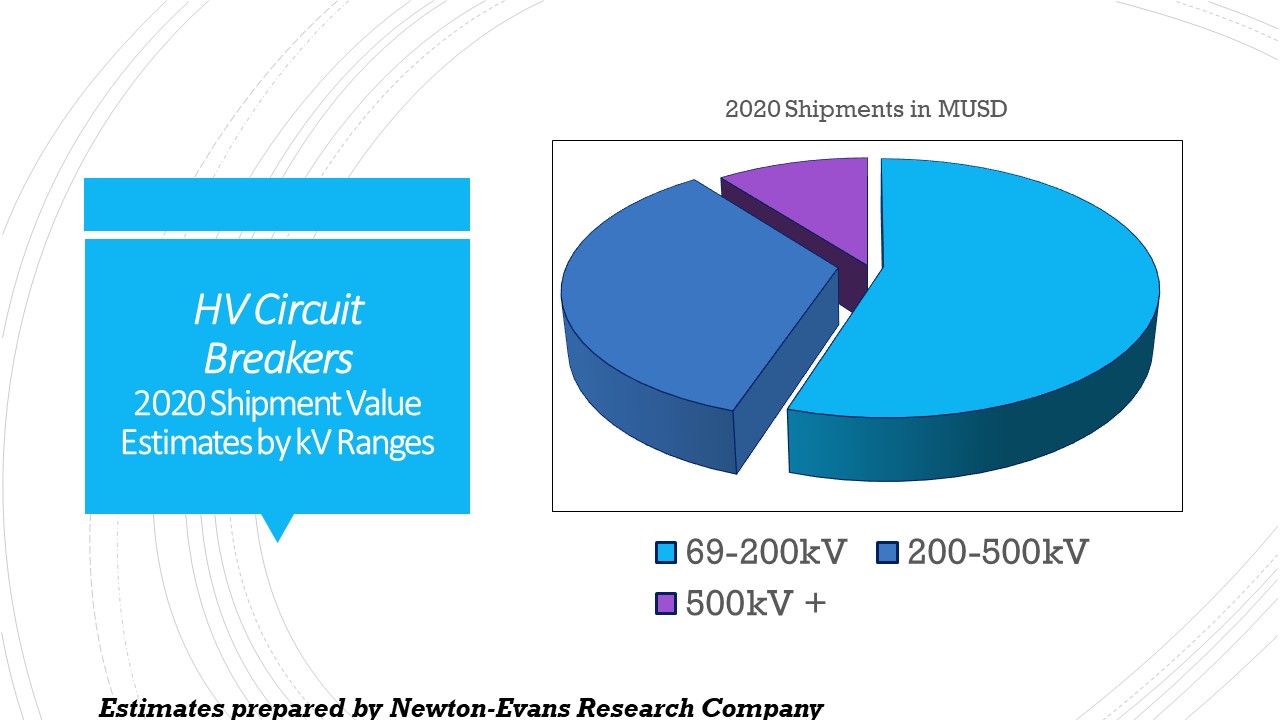

- HV circuit breaker shipments likely exceeded $900 Million in 2020, with more than one half of the total investment made for 69kV-200kV range of breakers.

Further information on the 2021-2023 series of U.S. High Voltage Equipment market overviews is available on the Newton-Evans Research Company website: https://www.newton-evans.com/our-reports/ for a brochure or to place an order for this new series or many other available T&D-related market reports. This series is available via online purchase and immediate download. Individual HV topical reports are priced at $150 per report, and the entire 15-report series is priced at $1,250.00. Newton-Evans Research Company, P.O. Box 6512, Ellicott City, Maryland 21042. Phone: 410-465-7316.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies