Role of Synchrophasors and Teleprotection Continues to Grow, Providing Better Situational Awareness and Visualization to Help Prevent Outages

Newton-Evans Research Company has prepared an interim news release based on preliminary findings from 59 large and mid-size North American electric utilities.

Among the early trends reported in this first of a four volume set of reports are these:

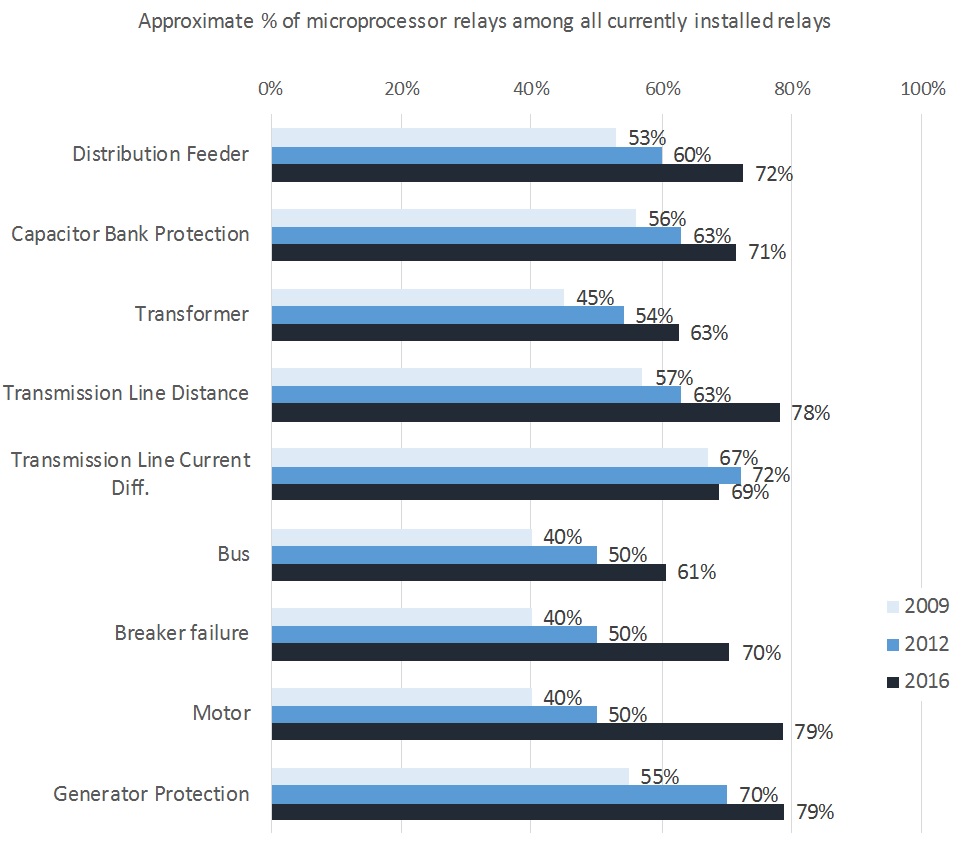

- The percentage of microprocessor relays in the mix of all protective relays used by utilities continues to increase with each passing year.

- The vast majority of new and retrofit units being planned for purchased are also digital relays, but in some of the protection applications studied, such as motor protection and large generator applications, and in installations where electrical interference is strong, electromechanical and older solid state relays continue to have a niche market position.

- Real-time analysis of synchrophasor data has become a key application for the emerging field of operational analytics for transmission operators.

Communications protocol usage patterns in North American utilities of all sizes continue to rely on DNP3, the dominant protocol in use in the North American region. IEC 61850 is found in some of the TOP 100 utilities, but is by no means prevalent as of mid-2016.

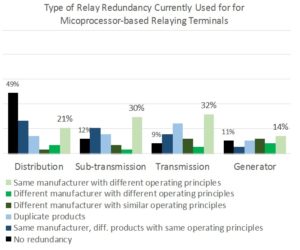

Relay redundancy being used for microprocessor-based relaying terminals varies by application as seen in the chart below.

The 2016 Newton-Evans survey of electric utilities includes more than 20 detailed product functionality topics, related technical questions, and market-related issues, together incorporating more than 250 items of information from each of the participating utilities.

This year’s study will result in a series of four reports published during June and July. These reports are geared to the planning needs of protective relay suppliers, power industry consultants, and utility protection and control departments. The four volumes include the North American Market Study, the International Market Study, Supplier Profiles, and Global Market Assessment and Outlook.

Further information on the research series The World Market for Protective Relays in Electric Utilities: 2016-2018 is available from Newton-Evans Research Company, 10176 Baltimore National Pike, Suite 204, Ellicott City, Maryland 21042. Phone: 410-465-7316 or visit www.newton-evans.com for additional information or to order the report series online.

In 2012, 20% of responding utilities said they plan to rely more in the coming three year period (2012-2014) on third party relay commissioning and testing services. One person mentioned that due to manpower shortages, they do not have enough personnel available to do testing as well as regular line work.

In 2012, 20% of responding utilities said they plan to rely more in the coming three year period (2012-2014) on third party relay commissioning and testing services. One person mentioned that due to manpower shortages, they do not have enough personnel available to do testing as well as regular line work. summary reviews and highlights from completed studies

summary reviews and highlights from completed studies