Why we believe the near-term investment priority for utilities of all types must be cyber security-related!

(Security is not always considered part of smart grid spending)!

First and foremost what stands in the way of more significant growth in smart grid-related investment is the state of the global economy. It isn’t totally doom and gloom, but then…. currently, all eyes are on Western Europe, and on the harbingers for economic growth or lack thereof, in North America, the slowdown in China and other parts of Asia. In mid-2011, we took a relatively cautious view of the outlook for smart grid investments, as many utilities simply could not afford to make significant investments then or now.

Our mid-2011 research series entitled The Worldwide Smart Grid Market in 2011: A Reality Check and Five Year Outlook Through 2015 was well received by key, clear-headed market participants and other observers of the smart grid marketplace, even though we had suggested that real growth in smart grid would be spaced out over many years, and overall smart grid market investments would grow only in the mid-upper single digits (on average) each year.

Well, let’s take a look at what is happening around the world that causes Newton-Evans to continue to retain a cautiously optimistic view of most smart grid market segments. We reported quite accurately on these likely developments in that mid-2011 study:

- Slowdown in China

- Critical financial and economic issues facing the Eurozone

- Minimal growth in Western Europe outside of the Eurozone

- Retrenchment in economic outlook for the United States (as it remains the single largest country market in the world).

- World Bank and NGO outlook that suggested continuation of low growth.

A few weeks back, there were some trade press headlines suggesting (incorrectly) that the smart grid was approaching umpteen billion dollars. To put much faith in that fairy tale of a report summary would be dangerous and misleading, as others have also stated. The true global market for all segments of smart grid activity (not counting infrastructure) relating to transmission, distribution, and consumer premises activities (AMI, DR, and the like), currently amounts to about 5% of that rose-colored glass outlook, or about $10 billion USD in our considered view. This amount includes all spending for control center systems, automation programs for substations and distribution networks, smart devices to monitor transmission activities, demand response and advanced metering infrastructure. This amount also includes all relevant operational software required to manage the data acquisition and analysis of real-time and historical data.

Certainly, unless the nation and the world lose the little positive economic momentum we now enjoy, there will very likely be a continuation of the mid-to-upper single digit growth rate overall for smart grid activities during the remainder of 2012 and through 2013. Some activities will grow faster (like DA), while others remain sluggish. Much hinges on the various steps being considered or enacted by regulatory and legislative bodies in countries around the world. A high percentage of these deliberations will consider the overall economic effects that such decisions will have on utilities and consumers of all types. Some major utilities will continue to forge ahead, as the daily webinars indicate they are doing. However, it is a rather small group of utilities that currently accounts for a very high proportion of smart grid spending, not just in North America, but globally. The majority of others are still either taking a “wait and see” attitude or hoping that their coffers will soon show more profitability that will enable those companies to make significant investments in one or multiple smart grid segments.

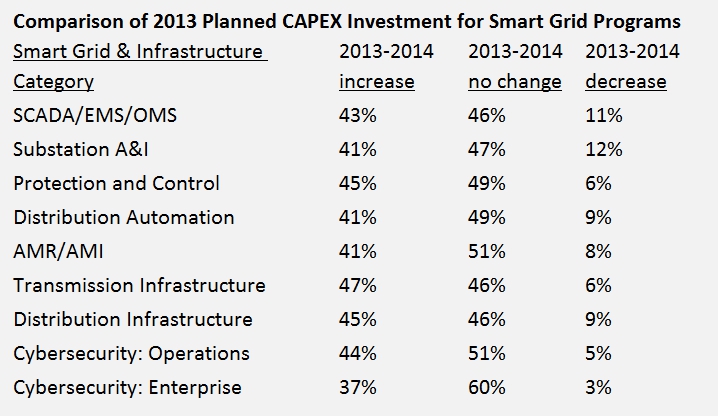

I am a believer that a lot of “wannabe” smart grid investments are being diverted, or will very soon have to be diverted, to better protecting utility IT and operational cyber assets, and this simply will take precedence over the requirements to upgrade equipment, smarten up field monitoring and control devices, revamp communications network architecture and re-energize the electric power grid itself.

This year, Newton-Evans Research has already undertaken a number of national and international studies of cybersecurity issues, and the findings lead us to believe that the single most critical issue facing utilities of all types is the near-term requirement to shore up cyber defenses, policies and procedures. Unfortunately, these cyber security investments will likely continue to usurp funding from other smart grid activities, but this investment must be a priority, in my opinion.

Keep in mind the first priority of every electric power utility – “keeping the lights on” means protecting the system at all costs. Thus, improving system protection and control procedures together with strengthening cyber defenses may well be the key aspects of smart grid development in the near term. We are “robbing Peter to pay Paul” in some real sense, but this is probably a very judicious way to invest for the remainder of 2012, based on what the “surveys say” at this time.

# # #

P.S. Looking for an opportunity to share in our findings? Join your colleagues in the power industry who have benefited from a full year of having accurate descriptions of the smart grid market and its constituent sub-markets. If you haven’t already subscribed to The Worldwide Smart Grid Market in 2011: A Reality Check and Five Year Outlook Through 2015 this would be a great time to do so. (See the reports page to order (http://www.newton-evans.com/reports/). Keep in mind that we will send the mid-2012 update with our compliments – at no extra charge – as soon as it is available.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies