Findings Corroborate Earlier Newton-Evans Studies Regarding “Mixed” Placement of Controls of Field Devices

The Newton-Evans Research Company today released key findings from its newly published study of electric utility plans for distribution automation. Entitled “North American Distribution Automation Market Assessment and Outlook: 2015-2017” the 89-page report includes coverage of more than 35 DA-related issues.

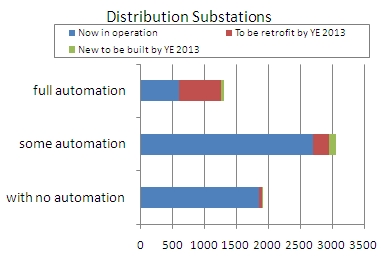

Progress Being Made with Distribution Automation Programs:

North American utilities are making good progress in developing and implementing new DA applications and telecommunications network upgrades. The overall DA market among North American utilities is approaching one billion dollars and will continue to grow each year for the foreseeable future.

DA Controls Placement:

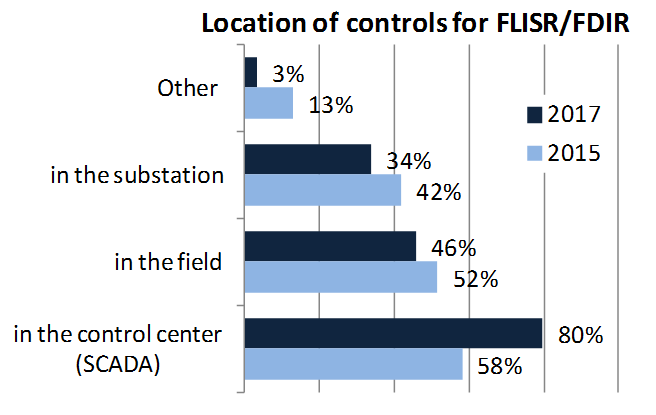

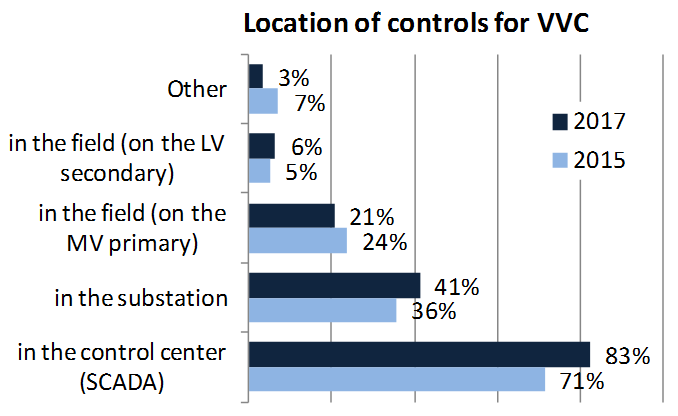

The placement of DA controls for field devices remains mixed. While some see controls being distributed to field locations, others are placing controls on substation automation platforms, while an even larger group is using control center systems-based approaches (centered on SCADA-DMS systems).

The outlook for controls placement in the future shows that utilities are bringing more controls for fault detection, isolation and service restoration (FDIR/FLISR) and for volt/var control (VVC) into the control center as shown in these charts.

Automatic Fault Sensing:

Devices providing information such as hot line status and fault indications are becoming a mainstay in many utility DA programs. IOUs and Canadian utilities were more likely to be using automatic fault sensing devices than were their counterparts at electric cooperatives or public power utilities. Usage patterns and plans for AFS devices were strongest among the respondent subgroup of very large utilities (those serving more than 500,000 customers). Of the subgroup using AFS devices, about one-third actively utilize the status of such devices in their DA schemes.

Integration of Communications and Controls for Distributed Generation into DA System Architecture:

By year-end 2014, only about 16% of utilities indicated some use of DA-related communications/controls while another 14% plan to integrate these for DG purposes by year-end 2017. In a related question, well over one third of the respondents indicated that they have a trial deployment to manage distributed energy resources within the DA system either underway or planned.

More than 30 additional topics are covered in the 2015-2017 Newton-Evans DA report. Seventy five major and mid-size utilities were surveyed and interviewed to gather the information for the report. This group provides a substantial sample, accounting for 20% of served customers and 19% of primary feeders across North America.

A supplemental North American DA market outlook synopsis for the years 2015 through 2020 will be released in March. The outlook supplement will provide DA market outlook information based on type, size and regional location of utilities.

Additional information on the North American Distribution Automation Market Assessment and Outlook: 2015-2017 report is available from Newton-Evans Research Company, 10176 Baltimore National Pike, Suite 204, Ellicott City, Maryland 21042. Phone 1-410-465-7316 or write to info@newton-evans.com

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies