Newton-Evans is in the planning stages of updating one of its flagship report series on the Worldwide Protective Relay Marketplace, slated for completion in the second quarter of 2016.

If you are a supplier of protective relays, relay testing or integration services, or if you are interested in following technology trends, we invite you to contact us to let us know what questions, comments or concerns you have about this $2.5 billion world market.

Send us an email to relaymarket@newton-evans.com with any ideas you have, or if you are interested in pre-subscribing to this report series. Pre-subscribers are encouraged to help us design the survey/questionnaire which goes out to hundreds of electric utility decision makers and planners around the world by submitting from 2-5 questions for consideration.

Overview

Newton-Evans’ Worldwide Study of the Protective Relay Marketplace: 2016-2018 is planned to be a multi-client study which encompasses the world market for protective relays in the electric utility industry. This four volume report series will be the seventh worldwide study of protective relays which Newton-Evans has undertaken. Participants in this market study will include utility engineers and managers from investor-owned utilities, municipal and provincial utilities, cooperative utilities within the United States and Canada, together with national power systems throughout the world. The study will measure current market sizes and contains projections on a world region basis for the next several years. The entire research program will define the product and market requirements which suppliers must meet in order to successfully participate in one or more of these diverse world market regions.

Newton-Evans Research Company estimates from an earlier 2012 relay market study indicate that the North American protective relay market stood at almost $600 million for both utility and industrial applications. It will be interesting to see how changes in the world market since completion of the 2012-2014 study will affect the outlook for 2016-2018.

Methodology

Field survey work is conducted using a mix of primary research methods including personal interviews, mail surveys, faxes, e-mail and follow-up telephone interviews by Newton-Evans Research Company staff. In addition to discussions with utility managers and influencers, Newton-Evans conducts interviews with protective relay industry officials to gather management impressions about the size, scope, direction and trends in the relay business. Discussions and information exchanges with international suppliers provide additional market insight. Over the past 15 years Newton-Evans has received thousands of completed surveys from utility personnel.

Topics

The survey-based findings in Volumes 1 (North American Market) and 2 (International Market) will discuss the following:

- Number of relays to be purchased over the 2016-2018 period

- Percentage of digital/microprocessor relays in installed base and planned for new and retrofit applications purchases

- Estimates of annual budgets for protective relay hardware purchases

- Level of testing for new digital relays

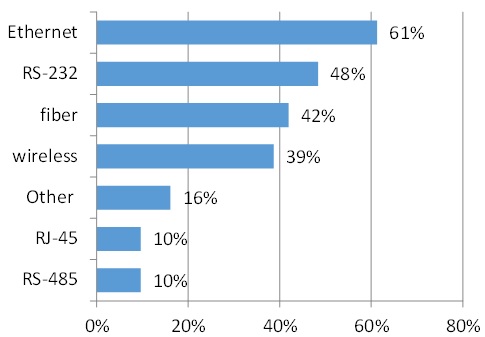

- Communications approaches for wide area networks

- Relay communications protocol requirements

- Types of relay scheme redundancy used for microprocessor-based relaying terminals

- Third party services for relay testing

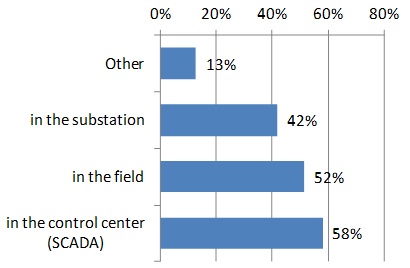

- Level of implementation of IEC 61850

- Uses of IEC 61850 within substation, for protection, control, and SCADA

- Use fiber optics to connect substations

- Outsourcing trends for testing, engineering, integration

- Use of condition based maintenance to reduce maintenance testing time of technicians

Volume 3 will provide a market forecast for the relay market through 2018. The survey sample from volumes 1 and 2 will be analyzed by world percentage of distribution line miles, transmission line miles, number of substations, nameplate capacity (as it applies to generator protection), and number of medium to large transformers included in the sample. This data is then used to estimate factory shipments according to type of relay (electromechanical vs. solid state), market segment (North American utilities, International utilities, and IPP/Industrial/OEMs), relay application (substation equipment, generators/motors, transmission lines, or distribution feeders), and market share by relay manufacturer.

Volume 4 profiles several of the major relay manufacturers and related equipment providers such as ABB, Alstom Grid, Basler, Beckwith, Cooper, Cutler Hammer, FKI, GE Multilin, Nari, RFL, Schneider, SEL, Siemens, and ZIV. Product descriptions and key contacts are provided, as well as reported 2014 and 2015 revenues where available.

In 2012, 20% of responding utilities said they plan to rely more in the coming three year period (2012-2014) on third party relay commissioning and testing services. One person mentioned that due to manpower shortages, they do not have enough personnel available to do testing as well as regular line work.

In 2012, 20% of responding utilities said they plan to rely more in the coming three year period (2012-2014) on third party relay commissioning and testing services. One person mentioned that due to manpower shortages, they do not have enough personnel available to do testing as well as regular line work.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies