On May 1, 2020, the President issued an Executive Order that forbids American electric utilities from purchasing (or utilizing) grid-related equipment obtained from countries viewed as adversaries.

There is not a clear definition of “adversary” provided in the executive order at this point in time. It seems that such a listing must be made public for utilities to know what to do in the coming months. Neither is there a clear definition of which products and equipment types are included, although common sense suggests that any “smart grid” equipment or device that can communicate externally would or should be closely evaluated.

However, this layman’s interpretation of the order puts the onus of having to identify the source country and component manufacturer for each component in the supply chain, and that is going to be a real challenge for some. This is because there is an increasingly complex multi-layered array of capital equipment, devices, systems and software in use at hundreds of American electric utilities. The onus will fall to an even greater extent upon the manufacturers and integrators serving the electric utility community.

There is a reasonable requirement for electrical equipment manufacturers to be able to identify the source country of origin (COO) for every component of a smart device – even down to the foundry level in some instances. This has been true for Milspec-related federal procurement for decades.

Importantly, domestic and international electrical equipment suppliers –both manufacturers and distributors – will now have to provide more depth to their equipment certificates that ensure traceability of origin, including tracing components from trusted sources located in approved countries.

It will come as no surprise that the initial list of “blacklisted” countries will very likely include China, North Korea, Iran and Russia, even though that list has not yet been officially made public. Fortunately, there is very little use of finished “smart” goods from these countries in operation in the U.S. at this time.

Just as important- or perhaps more so – for software systems as for hard goods and components, it will be critical to identify the specific locations used for developers of source code for all smart grid software modules, programs, apps and packages.

What is quite clear to me is that, in the US, and among Western nations in general, electric utility standards and procurement officials must be prepared to ascertain the sources of already deployed smart devices throughout the electric power grid that could adversely affect electric grid operations at some point in time. This is in addition to the thousands of smart grid projects now in the planning phases here at home and throughout the free world.

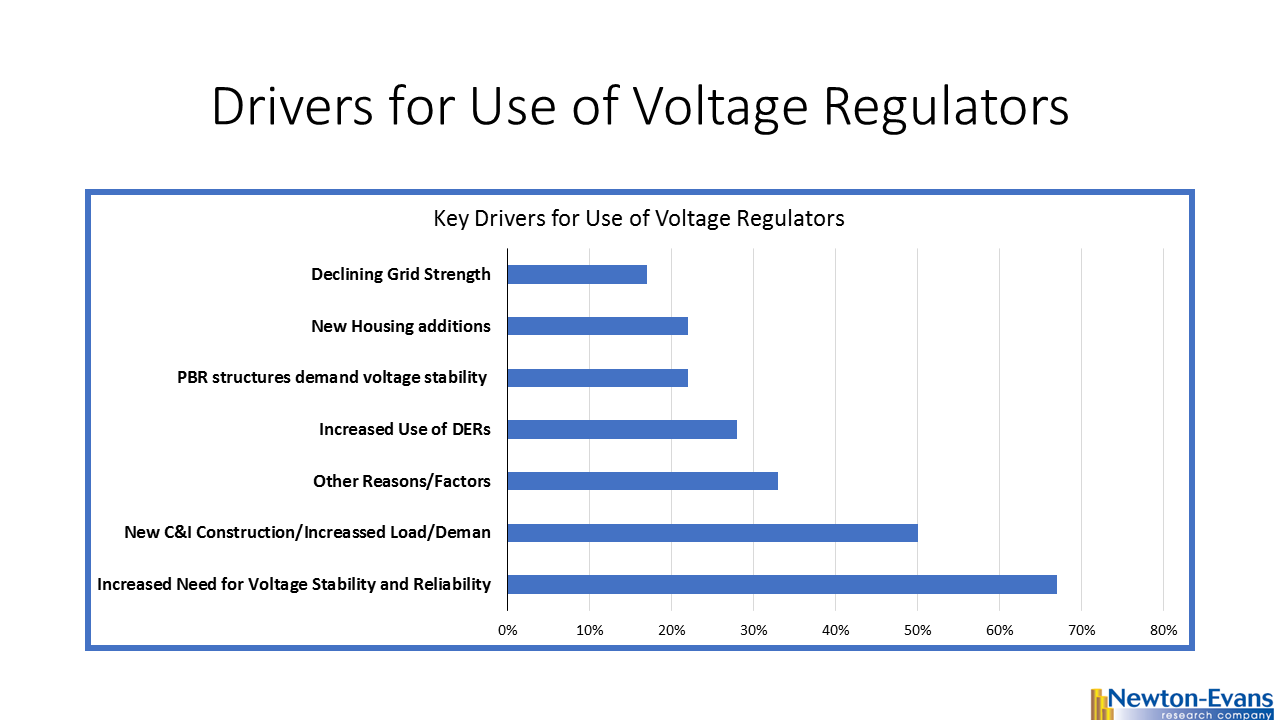

Among the plethora of smart grid devices now in use, the most important to vet will be digital relays – both loose relays and those embedded in generators, transformers, switchgear and other equipment. Next in importance are the hundreds of thousands of communications-centric transmission and distribution level monitoring and control devices including dynamic line rating devices, line monitors, pole-top RTUs, smart controllers for capacitor banks, voltage regulators, automatic reclosers and sectionalizers.

Smart substation equipment (protective relays, electronic measurement devices, precision time measurement devices, power quality monitors, synchrophasors, et al) is now deployed in a majority of the nation’s 65,000 primary T&D substations. At the consumer level, smart meters are at the top of the list of devices to be assessed, already deployed by the millions of units, whose component assemblies will likely need to be authenticated. Digital fault recorders are installed in hundreds of critical manufacturing sites. Motor controls and associated relays are installed in thousands of manufacturing plants and in power generation facilities.

Moving into the sector of distributed energy resources, there are smart devices and attendant communications modules involved in, and embedded with, both wind and solar generation as well as in energy storage. Wind turbine controls, smart inverters, small secondary substations whose final assembly may occur in the Western nations will have to verify sources of components, motherboards and microchips.

– Chuck Newton

Additional topics being studied include phase-to-ground voltages used in conjunction with VR; the use of VRs with other voltage improvement devices such as distribution feeder capacitors and substations capacitors; purchasing methods and preferences; installation methods, requirements for unit compliance with the latest IEEE requirements, wish lists for new VR product capabilities and a number of other pertinent topics.

Additional topics being studied include phase-to-ground voltages used in conjunction with VR; the use of VRs with other voltage improvement devices such as distribution feeder capacitors and substations capacitors; purchasing methods and preferences; installation methods, requirements for unit compliance with the latest IEEE requirements, wish lists for new VR product capabilities and a number of other pertinent topics.

A special “thank you” gift is is also available for participants at the end of the 12-question (largely multiple choice) survey. To date, we have well-thought-out responses in hand from major IOUs, public utilities and electric co-ops. Looking forward to your survey participation, we thank you kindly for sharing your insights. We are closing off survey data collection work on Friday, May 15, 2020.

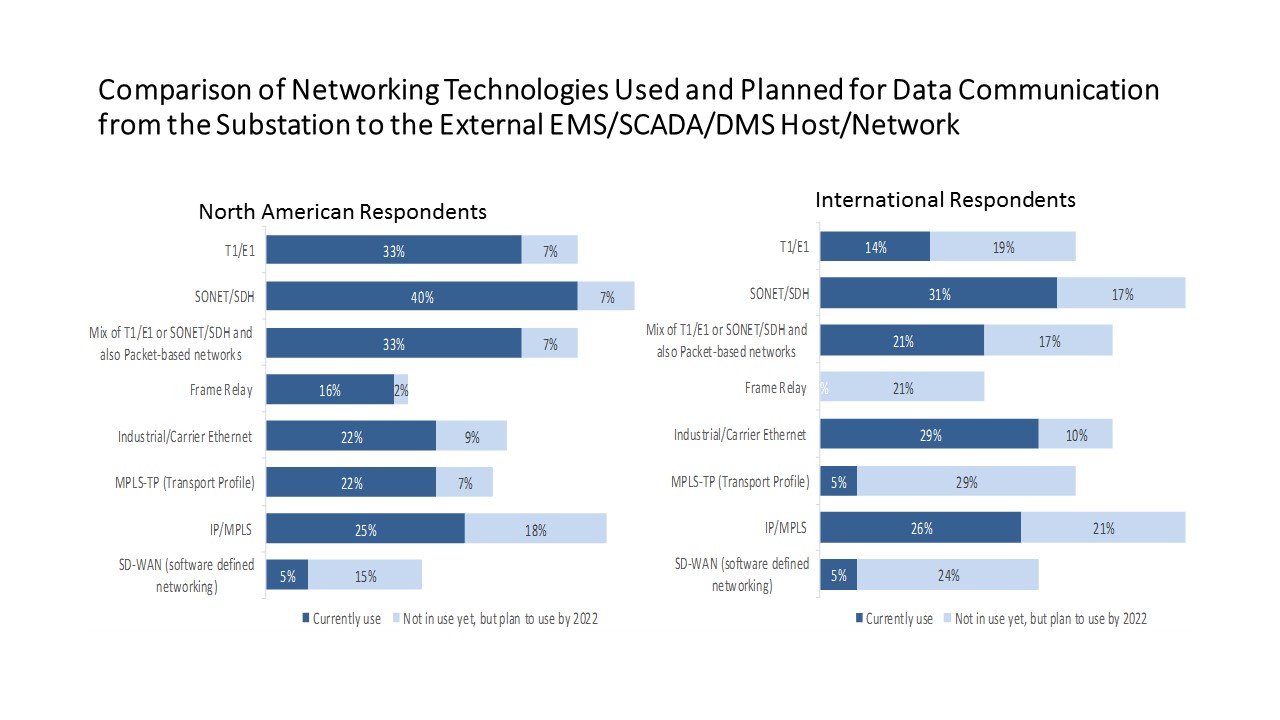

A special “thank you” gift is is also available for participants at the end of the 12-question (largely multiple choice) survey. To date, we have well-thought-out responses in hand from major IOUs, public utilities and electric co-ops. Looking forward to your survey participation, we thank you kindly for sharing your insights. We are closing off survey data collection work on Friday, May 15, 2020. The most prevalent networking technologies used in 2019 among the 42 international utility survey participants included SONET/SDH (31%), Industrial Carrier Ethernet (29%) and IP/MPLS (26%). Based on the survey sample, the leading technologies planned for development by 2020 include MPLS-TP (29%) and SD-WAN (24%).

The most prevalent networking technologies used in 2019 among the 42 international utility survey participants included SONET/SDH (31%), Industrial Carrier Ethernet (29%) and IP/MPLS (26%). Based on the survey sample, the leading technologies planned for development by 2020 include MPLS-TP (29%) and SD-WAN (24%).

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies