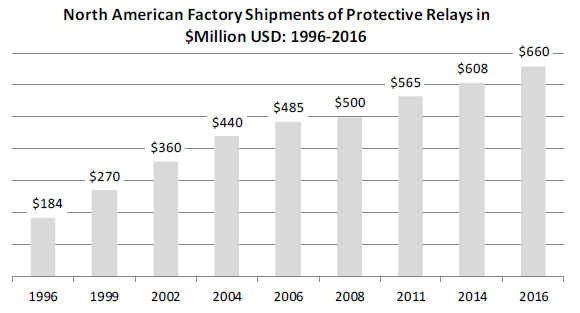

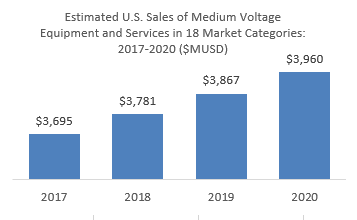

Newton Evans Research Company has recently completed Volume 1 (the North American Market) of the Worldwide Study of the Protective Relay Marketplace: 2019-2022, a four volume market report. Here are a few observations gleaned from the survey:

Survey respondents were asked, “Approximately what % of your relays have been in service for more than 15 years? (Best guess estimate)”

On average, 44% of relays in the utilities surveyed have been in service for more than 15 years. The average percent of relays older than 15 years among Canadian utilities surveyed was 61%; the average among U.S. Cooperatives was 25%.

Continue reading 35% of Utilities Surveyed Said More Than Half Of Relays Are Over 15 Years in Service

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies