Newton-Evans Research Publishes 14 Market Snapshot Reports on the Power and Distribution Transformer Industry in the United States.

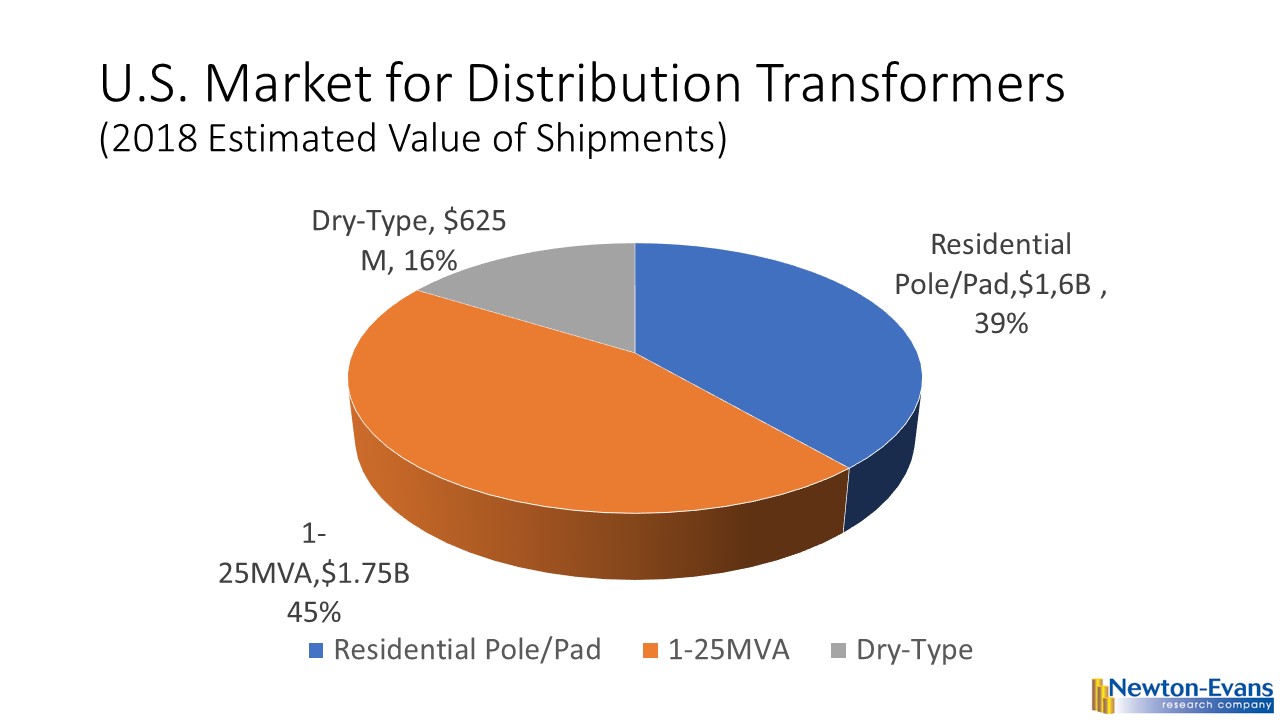

February 1, 2021. Ellicott City, Maryland. The Newton-Evans Research Company has announced publication of a set of 14 U.S. transformer market two-to-four-page summaries. The new series of market overview reports (executive market summaries) includes supplier listings, representative products, and estimated market size for each topic, vendor market share estimates and market outlook through 2023. Electric utilities accounted for about 81% of purchases of power transformers and 75% of distribution transformers. Commercial and industrial end-users accounted for the lion’s share of the dry-type transformer and special purpose transformer markets.

More small-power-to-very-large power transformers now are being manufactured in the U.S. recently, thanks to two key factors including: (1) the U.S. siting of large power transformer production facilities by several manufacturers over the past decade and (2) the mid-year 2020 Executive Order on Securing the United States Bulk Power System (though that EO is currently on hold/under review for 90 days).

The Newton-Evans Power Transformer Market Overview series ($1,250.00) includes U.S. market size, market share estimates and market outlook for these 14 transformer-related product and service categories: TX01 – Mobile Transformers; TX02 – Small Power Transformers; TX03 – Medium Power Transformers; TX04 – Large Power Transformers; TX05 – Very Large Power Transformers; TX06 – Shunt Reactors; TX07 – Special Transformers (Arc, Furnace); TX08 – Distribution Transformers (OH, Oil, 5kva+); TX09 – Distribution Transformers (Dry Type); TX10 – Distribution Transformers (Pad Mounted); TX11 – Network Transformers; TX12- Phase Shifting Transformers; TX13 – Transformer Life Management Services; and TX14 – Transformer Monitoring & Diagnostics Equipment and Services.

Further information on the 2021-2023 series of U.S. electric power transformer market overview series is available on the Newton-Evans Research Company website: https://www.newton-evans.com/our-reports/ for a brochure or to place an order for this new series or many other available T&D related market reports. This series is only available via online purchase and immediate download. Individual transformer topical reports are priced at $150 per report, and the entire 14-report series is priced at $1,250.00. Newton-Evans Research Company, P.O. Box 6512, Ellicott City, Maryland 21042. Phone: 410-465-7316.

-30-

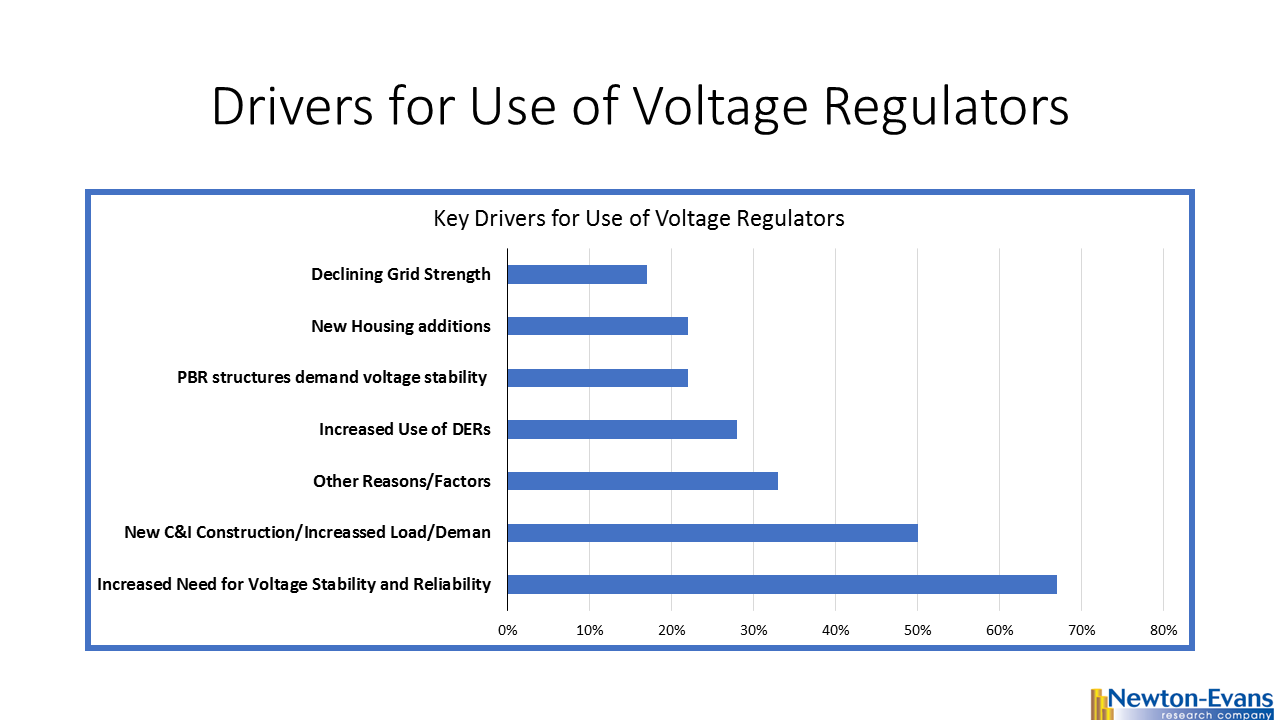

Additional topics being studied include phase-to-ground voltages used in conjunction with VR; the use of VRs with other voltage improvement devices such as distribution feeder capacitors and substations capacitors; purchasing methods and preferences; installation methods, requirements for unit compliance with the latest IEEE requirements, wish lists for new VR product capabilities and a number of other pertinent topics.

Additional topics being studied include phase-to-ground voltages used in conjunction with VR; the use of VRs with other voltage improvement devices such as distribution feeder capacitors and substations capacitors; purchasing methods and preferences; installation methods, requirements for unit compliance with the latest IEEE requirements, wish lists for new VR product capabilities and a number of other pertinent topics.

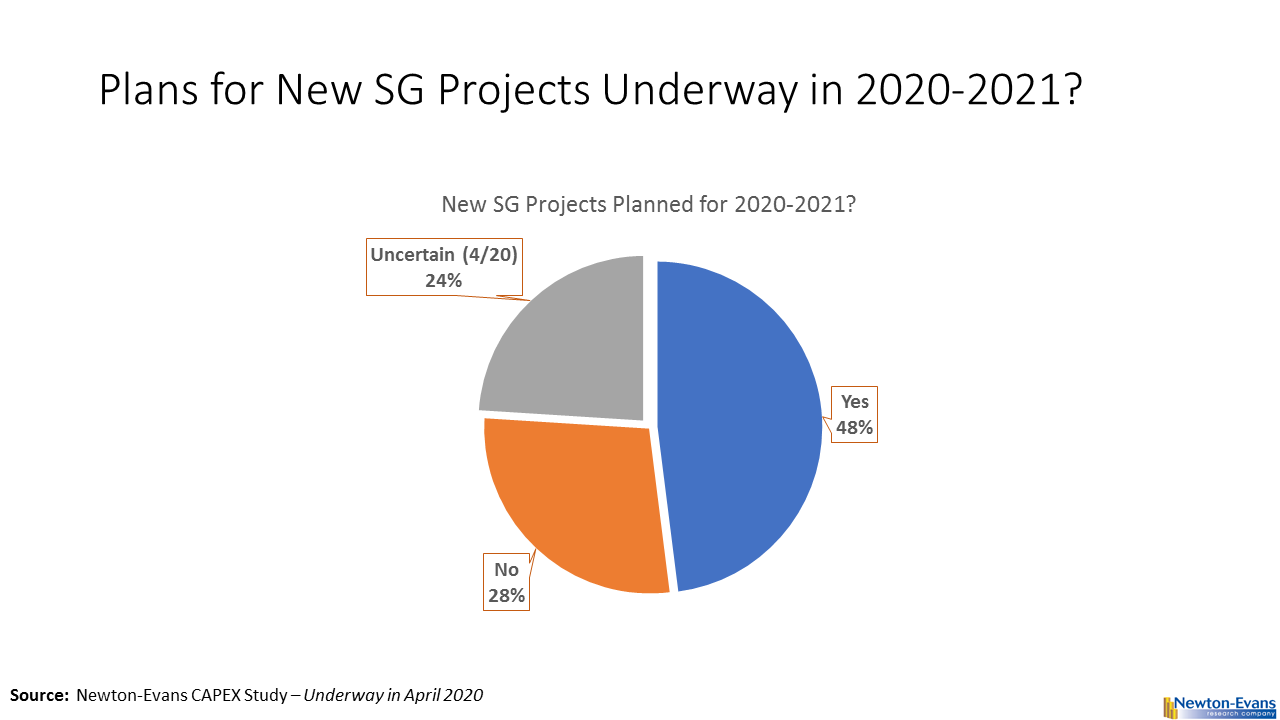

A special “thank you” gift is is also available for participants at the end of the 12-question (largely multiple choice) survey. To date, we have well-thought-out responses in hand from major IOUs, public utilities and electric co-ops. Looking forward to your survey participation, we thank you kindly for sharing your insights. We are closing off survey data collection work on Friday, May 15, 2020.

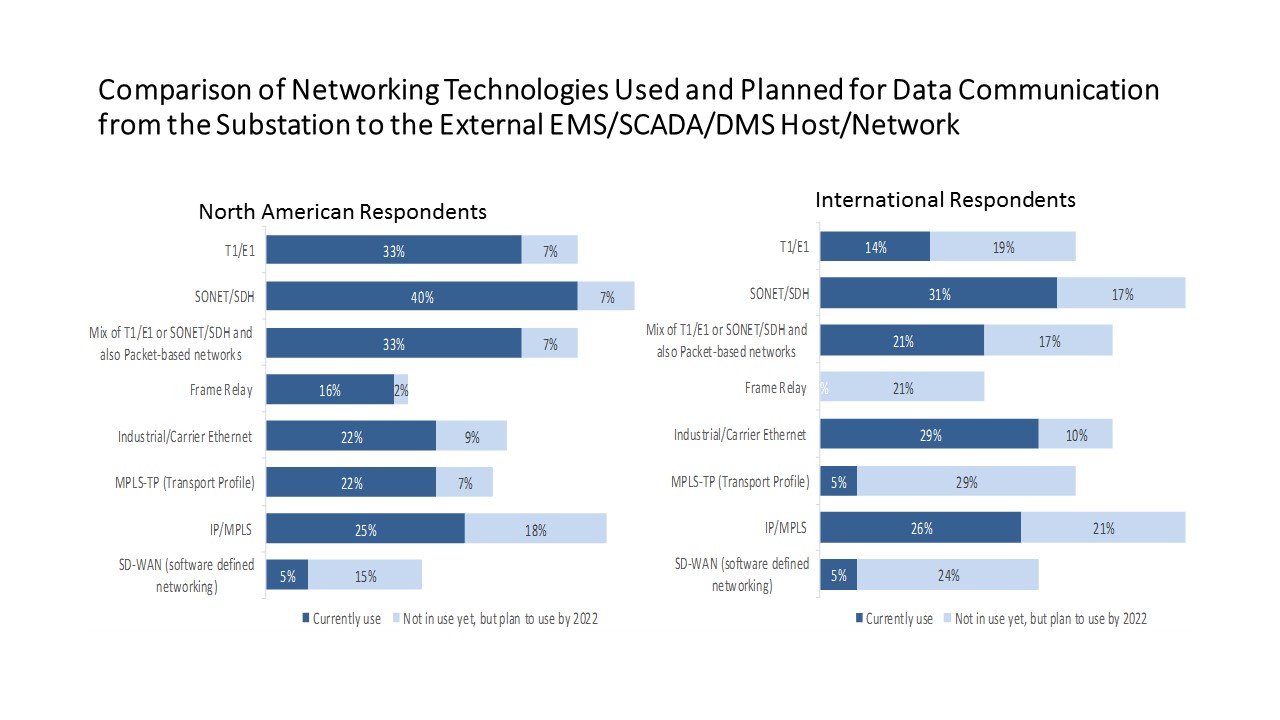

A special “thank you” gift is is also available for participants at the end of the 12-question (largely multiple choice) survey. To date, we have well-thought-out responses in hand from major IOUs, public utilities and electric co-ops. Looking forward to your survey participation, we thank you kindly for sharing your insights. We are closing off survey data collection work on Friday, May 15, 2020. The most prevalent networking technologies used in 2019 among the 42 international utility survey participants included SONET/SDH (31%), Industrial Carrier Ethernet (29%) and IP/MPLS (26%). Based on the survey sample, the leading technologies planned for development by 2020 include MPLS-TP (29%) and SD-WAN (24%).

The most prevalent networking technologies used in 2019 among the 42 international utility survey participants included SONET/SDH (31%), Industrial Carrier Ethernet (29%) and IP/MPLS (26%). Based on the survey sample, the leading technologies planned for development by 2020 include MPLS-TP (29%) and SD-WAN (24%).

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies